Do you search for 'mergers and acquisition final outline'? Here you will find all the details.

Table of contents

- Mergers and acquisition final outline in 2021

- 5 stage model of merger and acquisition process

- Merger and acquisition legal documents

- Merger and acquisition process ppt

- Outline of legal aspects of mergers and acquisitions in the united states

- Merger and acquisition process flow chart

- Corporate merger and acquisition

- Merger and acquisition law in usa

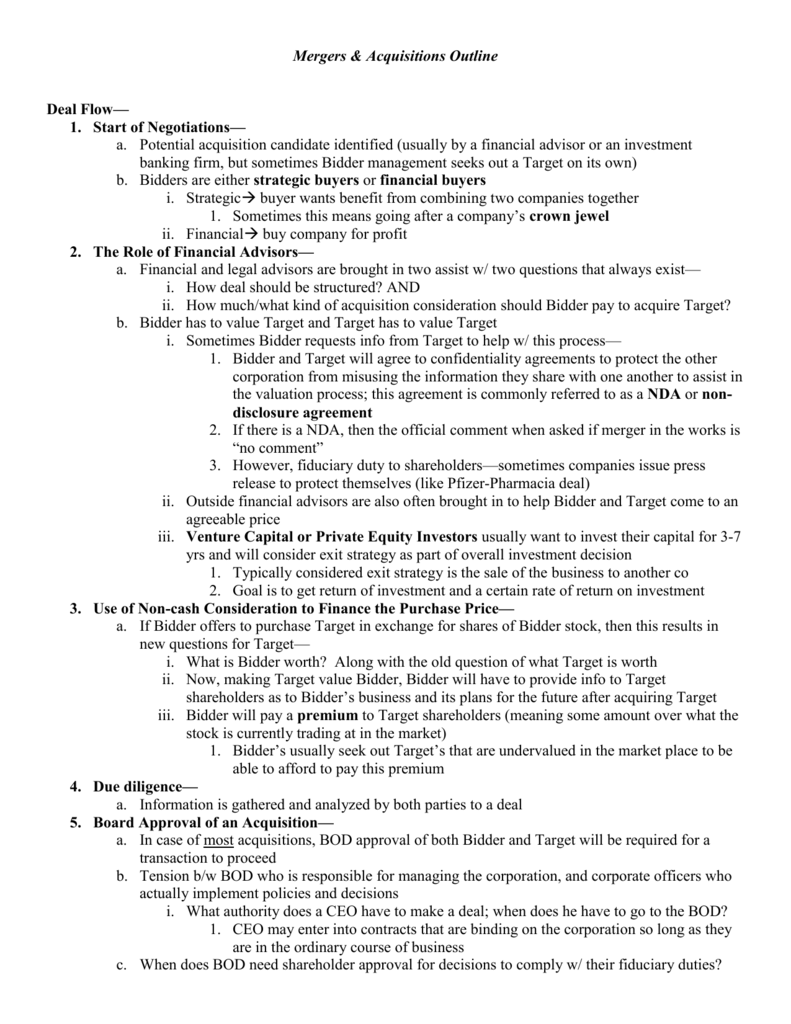

Mergers and acquisition final outline in 2021

This image demonstrates mergers and acquisition final outline.

This image demonstrates mergers and acquisition final outline.

5 stage model of merger and acquisition process

This picture shows 5 stage model of merger and acquisition process.

This picture shows 5 stage model of merger and acquisition process.

Merger and acquisition legal documents

This image shows Merger and acquisition legal documents.

This image shows Merger and acquisition legal documents.

Merger and acquisition process ppt

This picture shows Merger and acquisition process ppt.

This picture shows Merger and acquisition process ppt.

Outline of legal aspects of mergers and acquisitions in the united states

This image representes Outline of legal aspects of mergers and acquisitions in the united states.

This image representes Outline of legal aspects of mergers and acquisitions in the united states.

Merger and acquisition process flow chart

This image shows Merger and acquisition process flow chart.

This image shows Merger and acquisition process flow chart.

Corporate merger and acquisition

This picture representes Corporate merger and acquisition.

This picture representes Corporate merger and acquisition.

Merger and acquisition law in usa

This image shows Merger and acquisition law in usa.

This image shows Merger and acquisition law in usa.

How long does the mergers and acquisitions process take?

Mergers Acquisitions M&A Process Overview of the M&A Process The mergers and acquisitions (M&A) process has many steps and can often take anywhere from 6 months to several years to complete.

Why are mergers and acquisitions a good strategy?

M&As are a well publicised corporate strategy for growth and value creation through diversification, economies of scale and scope. They attract publicity due to the high failure rate of M&A initiatives and the enormous losses that have been encountered and devastate businesses.

What to know about mergers and acquisitions at UNSW?

The course will explore the development and execution of transactions including business acquisitions, takeovers, divestments, and initial public offerings. In addition, students will consider corporate and business strategies that motivate M&A transactions and the motivations of financial buyers such as private equity participants in M&A markets.

How to write a merger and acquisition template?

A merger or acquisition will succeed only when everyone understands their roles and responsibilities from the outset. Use this standard roles and responsibilities template to organize team members by project and list their duties at each phase of the merger.

Last Update: Oct 2021